Overview of AI Agent Cryptos

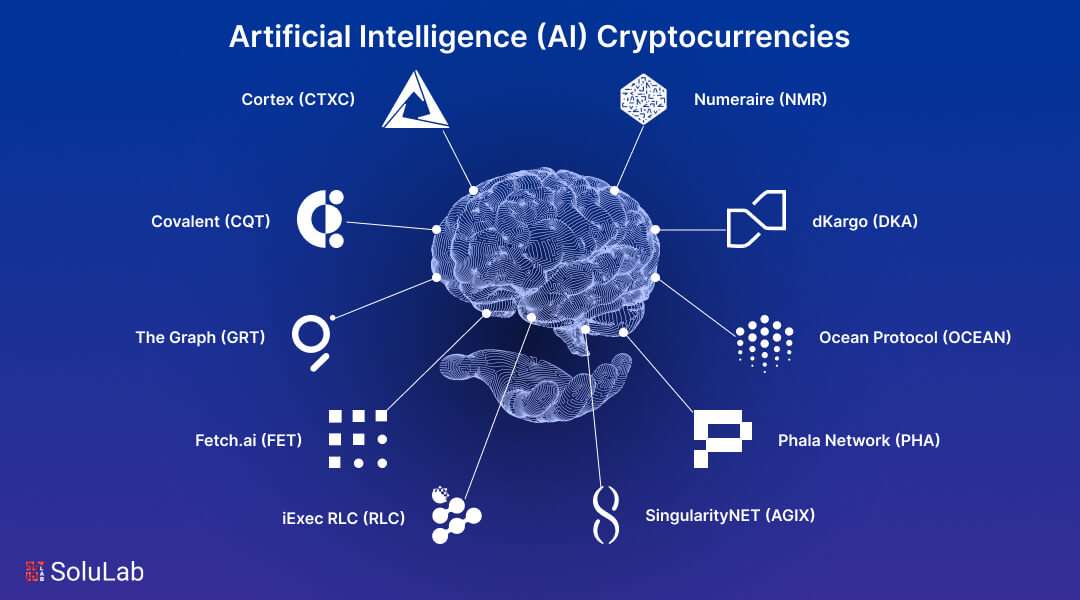

The crypto ecosystem is buzzing with excitement, and it’s largely thanks to the emergence of AI Agent Cryptos that are capturing the imaginations of investors and tech enthusiasts alike. In an age where artificial intelligence is becoming increasingly integrated into various sectors, the intersection of AI and cryptocurrency is providing fertile ground for innovation and speculation.

So, what exactly are AI agent cryptos? At their core, they are tokens that represent decentralized, algorithm-based agents capable of performing a myriad of tasks, often powered by advanced AI technologies. Think of them as digital personas that can engage in activities ranging from gaming and entertainment to social media engagement and perhaps even financial analysis. Each AI agent is essentially its own ecosystem, often with its own token, fueled by the potential to generate income or provide utility in the real world.

It’s easy to understand why they’ve become the latest trend—especially when you consider the historical success of memecoins in the crypto space. While memecoins like Dogecoin and Shiba Inu took the world by storm with their community-driven, lighthearted nature, the current wave of AI agents transforms that model into something that aims to offer genuine value. However, amid all the hype and euphoria, I can’t help but wonder whether we’ve entered an era of newfound opportunity or if we’re simply repeating the speculative cycles of the past.

Why the Hype?

- Novel Utility: Unlike traditional memecoins, many AI agents are built with specific functions in mind—creating a more compelling use case for potential investors and users.

- Market Trends: As AI technology continues to evolve and become more mainstream, there’s a natural inclination for investors to seek out ways to capitalize on its applications within the blockchain space.

- Community Engagement: These platforms often cultivate vibrant communities that encourage participation and investment, further amplifying the hype.

While some AI agent cryptos have emerged from established platforms seeking to capitalize on digital trends, others are springing up from fresh ideas that blend gaming, social interaction, and finance in exciting ways. Take the Virtuals Protocol, for instance. Launched as a potential incubator for AI technology, it has quickly become a focal point for AI agents seeking traction within the digital economy.

With more than 15,000 AI agents reportedly created on the Virtuals Protocol alone, it’s evident that interest in creating and interacting with these digital personas is skyrocketing. But with this explosion of new tokens comes the age-old question: How many of these projects are genuinely adding value, and how many are merely playing off the current excitement?

The landscape is rife with possibilities, yet it’s essential to approach with caution. In the anticipation of a new paradigm in cryptocurrency and AI convergence, one must ask: Are we witnessing the dawn of substantial technological evolution, or are we on the brink of a speculative bubble waiting to burst?

As AI continues to mature, these questions will only deepen, and the resulting narratives will shape not just investments but the very nature of digital interaction. Only time will tell whether this latest crypto craze sticks around or becomes a fleeting moment of hysteria. In the meantime, for anyone diving into this electrifying world, keep your wits about you—learn, question, and consider the underlying technologies before hopping on the AI agent bandwagon.

With each passing day, as new agents hit the market and spark conversations around their utility and potential, one can’t help but feel there’s much more to unfold in this ever-complex digital arena.

The Genesis of Virtuals Protocol

In the dynamic world of cryptocurrency, the genesis of the Virtuals Protocol marks a significant shift towards integrating AI within decentralized finance. Founded by Jensen Tang and Wiki Tu—two professionals with distinguished backgrounds that span biotechnology and consultancy—this protocol embodies a fusion of tech savvy with revolutionary ambition. Their journey began during the cryptocurrency boom of 2016 to 2017, but it wasn’t until the following bull market, facilitated by the surging popularity of the metaverse and NFTs, that they fully immersed themselves in the crypto ecosystem.

Initially, their venture aimed at harnessing the power of DAO structures to finance investments in NFTs and gaming projects through their first project, Path DAO. They raised million from top-tier crypto VCs and strategically invested in numerous promising ventures. However, as is often the case in the crypto sphere, timing proved to be everything; their assets depreciated significantly after reaching their peak values during the 2021 bull run. This led to a challenging landscape for Path DAO, particularly after the collapse of FTX, which further hindered their momentum.

But adversity breeds innovation. In the summer of 2023, Jensen and Wiki stumbled upon a groundbreaking research paper titled Auto-GPT: Online Decision Making

. This paper ignited a spark of inspiration, compelling the duo to pivot from traditional crypto applications towards an uncharted territory—AI agents. They envisioned a platform that not only supports virtual agents but also allows these digital entities to evolve in their own right, crafting independent narratives within gaming and online interactions.

With a renewed purpose, they presented a bold governance proposal to the Path DAO community in November 2023, to transition their efforts towards establishing the Virtuals Protocol. This proposal was accepted, catalyzing the migration of the Path token to the newly minted Virtual token on a 1:1 basis, signaling a rebirth for the project.

This transition has ushered in a world where AI agents reign supreme, spurring creativity and commercialization beyond what many could have envisioned just a year prior. The team’s experiments with AI agents quickly gained traction, using platforms like Roblox to demonstrate the capability of NPCs (non-player characters) powered by sophisticated AI algorithms. It’s a bold step toward creating a vibrant ecosystem of interactions that feel organic and engaging.

This adventurous spirit is evident in the launch of Luna, the protocol’s first crypto AI agent, in October 2024. Described as the “visual and lead vocalist” of an AI-created band, Luna encapsulates the core mission of Virtuals—to not only explore AI interactions but to monetize these engagements. The success of Luna and other subsequent AI agents initiated a remarkable rise in the value of the Virtual token, kicking off altcoin rallies that echoed the feverish pace of early memecoin trading. But there’s a crucial distinction to make: unlike typical memecoins, many of these AI agents have a defined role, potentially generating real revenue, thus placing them firmly in the crosshairs of both investors and analysts looking to the future.

What sets the Virtuals Protocol apart is its unique operational model, which encourages the development of AI agents tailored for gaming, social interactions, and even virtual relationships. Each AI agent serves as a decentralized autonomous organization (DAO), creating an environment where they can engage in activities meant to generate profit, reminiscent of traditional business models but innovated for the digital age.

This shift to AI-driven interactions shapes not only the identity of the protocol but also the potential opportunities available. By leveraging their expertise, Jensen and Wiki have turned the initial skepticism surrounding AI in crypto into a thriving narrative—one that resonates with the broader trends in the tech world today.

As we continue to witness the proliferation of AI agents, it becomes compelling to consider the broader implications of this landscape. The question on everyone’s mind is: will this protocol elevate AI interactions into something substantial, or are we merely scratching the surface of a larger evolution? As potential investors delve deeper, the story of Virtuals invites those curious about the future of cryptocurrency and AI to speculate, analyze, and engage.

Mechanisms of the Virtuals Ecosystem

At the very heart of the Virtuals ecosystem lies an intricate tapestry of mechanisms that dictate how AI agents operate and interconnect with each other, as well as with their human creators. Every aspect of this ecosystem is meticulously designed to facilitate interaction, creativity, and, ultimately, revenue generation. But how exactly do these unique components come together to form a functioning marketplace for digital personas? Let’s break it down.

Firstly, the launching of AI agents on the Virtuals Protocol hinges on the virtual token, which is utilized to create liquidity pools for new agents. Each agent is linked to its own token, and the attractiveness of these tokens directly influences the overall health of the ecosystem. To ensure traders and investors are incentivized to participate, the protocol implements a model that requires pool contributions to be made using virtual tokens, inherently boosting their demand. In simpler terms, when someone looks to create or purchase an AI agent, they first need to acquire virtual tokens, creating a cycle of demand that has financial implications for the token’s market performance.

Another significant mechanism involves utilizing a novel protocol named Generative Autonomous Multimodal Entities, or GAME for short. In essence, this framework enables users not only to create standalone AI agents but also to interact with them in ways that are dynamic and engaging. Currently, over 15,000 AI agents have been birthed from this innovative architecture, each showcasing unique functionalities that reflect the breadth of human creativity and interaction design.

Integration with Gaming and Entertainment

One of the standout features of the Virtuals Protocol is its explicit focus on gaming and entertainment applications. Consider the capability for AI agents to operate as advanced non-playable characters (NPCs) in various digital environments. Imagine stepping into a virtual world in Roblox, where every interaction with NPCs is powered by sophisticated AI algorithms, giving them the ability to learn and adapt from player behavior. This merges the essence of gaming with the allure of AI, setting a new standard for how engaging experiences could be in the digital realm.

Moreover, the protocol also contemplates virtual relationships. Projects could create AI companions—think AI-powered friends or partners perfectly tailored to fit one’s lifestyle. These relationships could have meaningful interactions, solidifying the agent’s place in users’ lives. The horizon of possibilities is incredibly broad, ranging from companionship and emotional support to interactive storytelling and performance art.

Decentralized Autonomous Organizations (DAOs)

An exciting element of each AI agent within the Virtuals ecosystem is that it functions as its own DAO. Unlike traditional business models, where decisions might be made by a centralized body, these AI agents participate in consistent governance wherein decisions on revenue allocation or project direction are managed autonomously. It’s a democratized approach to resource management that empowers both the AI agent and its token holders. Think of it as having multiple organizational units working harmoniously, each contributing to the collective growth and sustainability of the entire ecosystem.

Revenue Generation Models

Underpinning this entire framework is a keen focus on revenue generation. The protocol has been designed to ensure that each AI agent is equipped with an ERC-6551 wallet. This novel implementation enables agents to continually accrue revenue while facilitating seamless distributions back to the holders of their respective tokens. A prime example is Luna, the first agent who, according to reports, has already generated hundreds of thousands of dollars in USDC. The future appears especially bright for such entities, as they can drive value not only through their own functionalities but also by collaborating or interacting with other agents and applications within the Virtuals network.

This innovative approach deeply engages users, giving token holders a vested interest in the activities of their AI agents. When these agents generate income via creative endeavors or interactions, the resulting revenue has the potential to be reinvested back into the ecosystem, essentially creating a self-perpetuating cycle of growth and investment. However, it remains imperative to recognize that while some agents may thrive and monetize successfully, a significant number still struggle to find revenue streams. The presence of high-quality agents will be crucial in shaping the long-term sustainability of the ecosystem.

Tokenomics: Driving Growth and Stability

The tokenomics surrounding the Virtuals Protocol further fortify its mechanisms. With a capped supply of 1 billion virtual tokens, 60% are allocated for public circulation, allowing the community to engage robustly within the ecosystem. The diverse allocation mechanism invites broad participation while preserving an equilibrium that can help stabilize the token’s price. Furthermore, the vesting schedule highlights a commitment to long-term vision, fostering trust among users.

This well-rounded structure brings in another layer. As competition among AI agents increases, they will need to be unique and innovative, ensuring they don’t merely ride the coattails of hype but rather contribute real value. This sentiment resonates particularly well with investors; the more utility an AI agent offers, the better its chances of attracting a loyal audience and, with it, sustained financial success.

Ultimately, the mechanisms of the Virtuals ecosystem are built on a foundation of creativity, innovation, and community. They promote active user engagement while evolving into something far more profound than mere speculation on token prices. The dance between AI sophistication and user interaction creates an intricate web where both can coexist and thrive. I find it fascinating to consider that as the Virtuals Protocol continues to grow, the real winners will be those who are willing to experiment, innovate, and engage deeply with the digital personas taking shape.

What remains to be seen is how these mechanisms will evolve over time and whether the ecosystem will yield a new generation of AI agents that can stand the test of time—surviving beyond trends and crafting lasting connections within the vast realms of virtual existence.

Revenue Generation and Tokenomics

Delving deeper into the intricacies of the Virtuals Protocol, we must discuss its revenue generation models and tokenomics, which serve as the backbone of the entire ecosystem. In this fervently evolving landscape, these elements are not merely background details; they are vital cogs that dictate the success of both the protocol and the myriad of AI agents operating within its framework.

Exploring Revenue Generation

Firstly, the revenue generation aspect of this protocol is notably compelling. Each AI agent on the platform is equipped with an ERC-6551 wallet, a valuable feature that empowers agents to continuously earn revenue. Unlike many traditional crypto models where value dissipates after trading, Virtuals harnesses a dynamic, ongoing revenue stream. When agents like Luna perform tasks or engage with users, they generate income—not just for themselves but also for the token holders connected to their operation. Imagine Luna, for example, earning significant funds through musical performances or collaborations within gaming scenarios; the revenue can be redistributed back to its holders, hence fortifying the value proposition.

This model encourages a symbiotic relationship between the AI agents and their human counterparts. As these digital personas grow, flourish, and start generating revenue, token holders—those who invested in the agent’s corresponding tokens—can reap the benefits. Furthermore, the potential for revenue generation enhances community engagement. The more engaging and successful an AI agent is, the more interest it garners, leading to greater investments into the ecosystem, thus creating a loop of growth and opportunity.

The Tokenomics of Virtuals Protocol

Examining the tokenomics reveals another layer of financial machination. The virtual token operates within a capped supply of 1 billion coins, with around 60% intended for public circulation. This robust distribution model not only allows for broad public participation but also mitigates inflationary pressures, preserving value across the ecosystem. Keeping in mind that 35% of the token supply is allocated to the ecosystem, these tokens can be utilized for infrastructure development and incentivizing participation—key elements in fostering a sustainable community-driven approach.

Moreover, the vesting schedule and allocation strategy show signs of maturity within the protocol. By ensuring that insiders’ holdings are locked for a period, the structure inherently deters market manipulation and encourages long-term investment. This transparency regarding token allocation helps build trust among users, an essential factor in the volatile world of cryptocurrency trading.

Challenges to Consider

However, while the financial models may look appealing on paper, they raise important considerations. The challenge that looms over the system lies in the disparity between revenue-generating agents and those that do not perform. If most AI agents fail to produce income, speculation could shift starkly towards skepticism, potentially leading to a market reminiscent of meme coins, where dilution is rampant, and only a handful of players stand out. The challenge of maintaining meaningful engagement and revenue generation amidst a sea of new entrants can’t be overstated. It’s crucial that users remain selective in their investments, focusing on quality over quantity, lest the hype surround AI agents be unsustainable.

Tabulating the Economics

| Element | Details |

|---|---|

| Total Supply of Virtual Tokens | 1 Billion |

| Public Circulation | 60% |

| Liquidity Allocation | 5% |

| Ecosystem Fund | 35% |

| Revenue Wallet Type | ERC-6551 |

This cycle of revenue generation and prudent tokenomics illustrates that being part of the Virtuals ecosystem offers far more than mere speculation on price movements; it’s an engagement with a living, breathing marketplace that thrives on creativity and unique interactions. The nature of this engagement underscores the opportunity for transformations in how we perceive value within blockchain technologies.

What Lies Ahead

Opportunities and Potential Challenges

As the landscape of AI agent cryptos continues to evolve, it’s pivotal to shed light on the myriad opportunities that lie ahead, along with the challenges that could potentially hinder growth. At the forefront, we have the undeniable allure of diverse revenue streams and innovative applications that AI agents can offer, paving the way for new use cases that extend well beyond mere speculation. The integration of advanced AI with decentralized technologies not only promises enhanced forms of interaction but also presents unique avenues for monetization, serving as a magnet for both developers and investors.

Opportunities in Revenue Generation

One of the most promising aspects of AI agent cryptos is their capability to generate ongoing revenue through various channels. AI agents, powered by sophisticated algorithms, can engage in tasks that yield economic benefits. For instance, as these agents take on roles in gaming, entertainment, or social media platforms, they can earn tokens or fiat by creating engaging content, offering services, or even performing like virtual influencers. This cyclical relationship allows for a natural flow of income back to the token holders.

To illustrate, imagine a future where gaming experiences are tailored by AI agents that learn from player behaviors and preferences, enhancing personalization. These agents could drive significant interest and user engagement, which, in turn, translates to higher revenue opportunities not just for themselves but also for their token holders through mechanisms that reward participation. If implemented well, the virtual economy surrounding these AI agents could flourish, leading to sustainable growth trajectories.

The Appeal of DAOs

Another enriching facet of AI agents within the Virtuals Protocol is the incorporation of decentralized autonomous organizations (DAOs). Each agent operates as an independent DAO, allowing for decentralized governance where stakeholders can influence decision-making processes. This attracts those who seek active participation in the evolution of the project while promoting loyalty and engagement within the community.

- Investors Take Charge: Token holders gain the right to vote on important proposals such as revenue distribution, project direction, and community initiatives. This not only empowers the community but also ensures that decisions are made transparently.

- Collaboration Potential: DAOs can collaborate with other initiatives, enhancing their impact and reach. Such partnerships may accelerate development and expand the functionality of existing AI agents, ultimately benefiting the ecosystem as a whole.

The potential for shared governance models promotes a sense of ownership and commitment, optimizing community investment in the success of AI agents. Engaging users in this manner could encourage a more robust, proactive community that contributes to the stability and growth of the Virtuals ecosystem.

Challenges Lurking in the Shadows

Moreover, the regulatory landscape presents its own set of complexities. As the integration of AI agents within financial ecosystems increases, regulators may impose restrictions that complicate operations. If the public perceives these agents—or the protocols they operate on— as being opaque, it could attract scrutiny that stifles innovation. In an environment where transparency is paramount, any attempt to obfuscate information could lead to mistrust among users and ultimately affect investment willingness.

Maintaining Quality Over Quantity

In tandem, fostering a strong culture of accountability and transparency will be key. The emerging narrative surrounding AI agents is exciting, but it requires an unwavering commitment to keeping users informed and engaged with clear communication regarding the economic dynamics at play. Regular updates about revenue generation, governance decisions, and project developments will bolster credibility and trust among community members.

Table of Opportunities and Challenges

| Opportunities | Challenges |

|---|---|

| Diverse revenue streams from AI engagements | Potential dilution of quality AI agents |

| Decentralized governance through DAOs | Regulatory scrutiny on AI integrations |

| Enhanced community involvement fosters loyalty | Need for transparency around financial dynamics |

| Possibility for cross-collaboration between agents | Risk of market volatility from low-performing agents |

The path forward for AI agent cryptos, particularly within the Virtuals Protocol, shines with possibilities and exciting prospects. Nonetheless, stakeholders must approach with diligence, ensuring they champion innovation while maintaining a vigilant commitment to quality assurance and transparency. The ability to navigate these waters will ultimately influence the fate of AI agents and their place in the overarching narrative of cryptocurrency’s future.

Future Outlook and Insights on AI Agents

As we look toward the future of AI agents within the realm of cryptocurrency, it’s hard not to feel a sense of both excitement and trepidation. The convergence of artificial intelligence and blockchain technology presents a world of untapped potential, filled with opportunities that could reshape not only how we interact with technology but also how value is created and distributed across diverse sectors. Both seasoned investors and newcomers to the space are buzzing with questions: What will the next wave of AI agents look like? How will these digital personas evolve and respond to our needs? And importantly, how can we ensure that this landscape remains sustainable and beneficial for all participants involved?

Anticipating Innovation

The trajectory ahead hints at profound innovation. As AI continues to augment user experiences in gaming, entertainment, and even personal relationships, we can envision a future where these AI agents evolve to become integral companions in our digital lives. Imagine AI agents that can not only adapt to our preferences over time but also provide services tailored to our routines—personalized recommendations for everything from entertainment to financial decisions. This evolution isn’t just about smarter technology; it’s about creating meaningful interactions that can inspire loyalty among users and, in turn, bolster revenue generation for those behind the scenes.

Moreover, the integration of decentralized governance through DAOs opens up exciting possibilities. The prospect of having AI agents that can autonomously make decisions based on collective stakeholder input allows for a more democratic approach to development. These agents could coordinate efforts, collaborate on projects, or even engage in competitive endeavors which could redefine our understanding of community engagement within the cryptocurrency realm.

Market Adaptability and Growth

Challenges to Navigate

Moreover, regulatory challenges continue to linger over the horizon like a storm cloud. Governments and institutions around the globe are grappling with how to classify and regulate new technological developments, including cryptocurrencies and AI applications. As they seek to implement safeguards for investors and users, any perceived opacity within projects could lead to heightened scrutiny, which might stifle innovation. Transparency should be upheld as a core tenet of AI agent protocols, with mechanisms in place to regularly update stakeholders about revenue streams and decision-making processes. Clear communication builds trust, which in turn fosters community investment and long-term viability.

The Art of Balancing

In this fast-paced environment, it’s vital that we remain not just participants but informed players in this unfolding narrative. The future of AI agents is a collaborative journey; one that stands ripe for exploration. It’s thrilling to think that innovations today could lay the groundwork for tomorrow’s titans, with the potential to transform how we view interaction—both on a social and a financial level. As we look ahead, the intersection of AI and cryptocurrency is undoubtedly an exciting space to watch. Who knows what extraordinary developments are just around the corner?

The essence of this venture lies in our shared vision—may we boldly stride into this new era together, fostering innovation while safeguarding the foundational principles that can enable meaningful interactions and genuine growth.