BITCOIN’S PATH TO TRILLION

The cryptocurrency landscape is in a state of rapid evolution, and Bitcoin, the king of cryptocurrencies, is at the forefront of this transformation. As we stand on the brink of what some analysts predict could be a staggering trillion market cap for Bitcoin, it’s essential to understand the underlying dynamics that could propel it there. This prediction isn’t just a pipe dream; it’s grounded in a confluence of technological advancement, increased adoption, and sociopolitical influences.

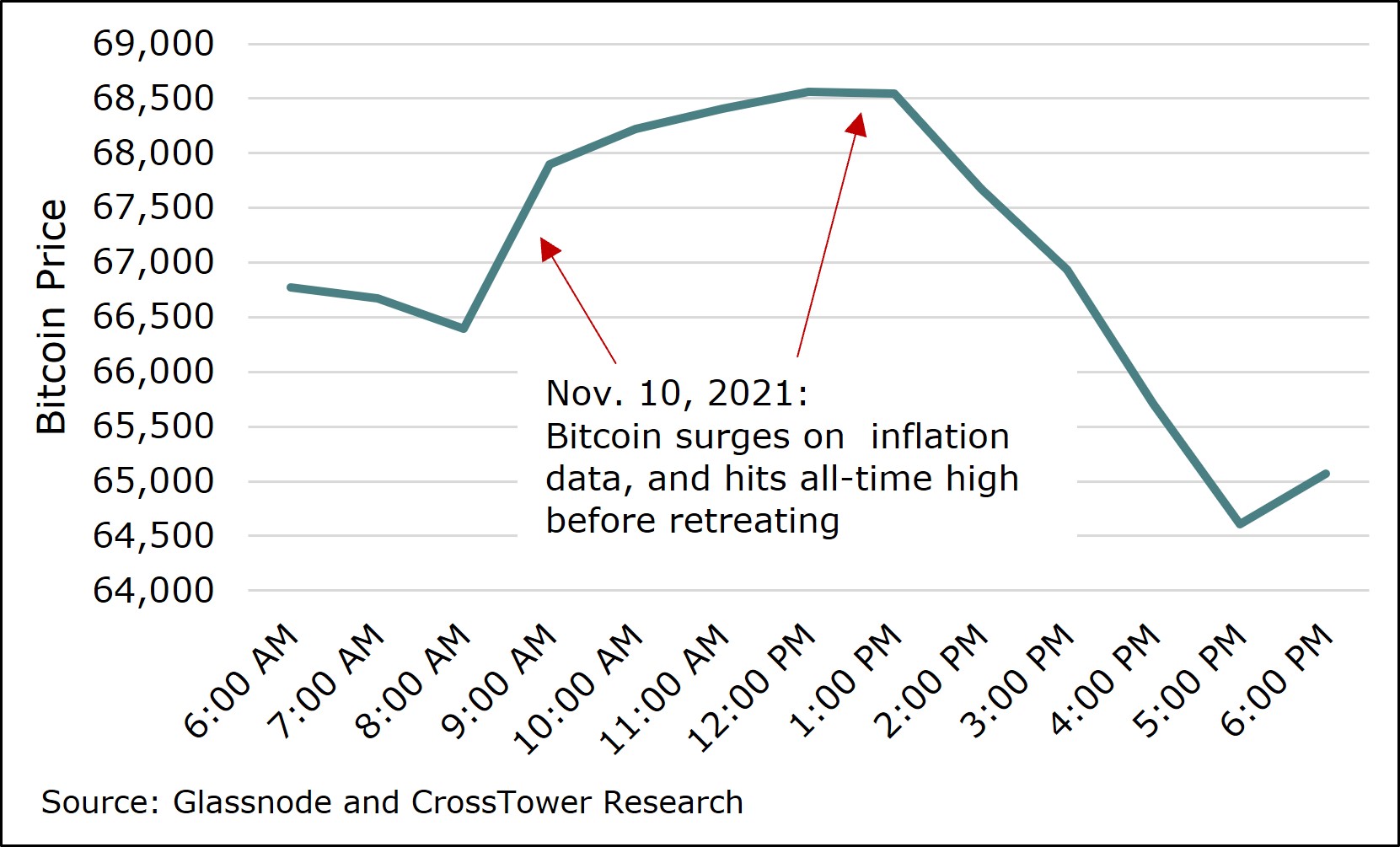

Historically, Bitcoin has demonstrated an unparalleled capacity for growth. Back in its nascent days, it was virtually valueless, but as it gained traction, reaching an approximate value of ,000 in late 2013 set the stage for the future. Fast forward to today, and the market cap of Bitcoin can fluctuate wildly within weeks or even days. It’s a rollercoaster of values, emotions, and, at times, sheer panic. In November 2021, Bitcoin’s market cap neared a staggering trillion. So, how can we realistically chart a course to trillion?

This exponential growth hinges on several interconnected factors:

- Institutional Adoption: As major companies like Tesla and Square have incorporated Bitcoin into their financial portfolios, we’re witnessing a shift in perception—from speculative asset to serious investment vehicle.

- Global Economic Climate: With ongoing inflation concerns around the world, many investors are looking at Bitcoin as a hedge against traditional economic vulnerabilities.

- Technological Improvements: Developments in blockchain technology, such as the Lightning Network, are making Bitcoin transactions faster and cheaper, thus enhancing its utility.

- Media Representation: The narrative built by influential figures, like former President Trump, can significantly sway public sentiment, leading to price fluctuations that can escalate into broader market trends.

- Decentralized Finance (DeFi): The rise of DeFi applications utilizing Bitcoin could exponentially increase demand for the cryptocurrency.

These factors contribute to a narrative that paints a compelling picture for Bitcoin’s potential moonshot. Skeptics might argue about volatility or regulatory scrutiny; however, I believe these concerns mirror the initial skepticism around the internet in its early days. Just as we saw companies rise out of the dot-com bubble, I see a budding ecosystem around Bitcoin that will also withstand the tests of time—albeit with a fair amount of turbulence along the way.

To detail these projections further, let’s break down a hypothetical scenario by 2030, leveraging different data points for clarity:

| Year | Bitcoin Price | Market Cap (Approx.) |

|---|---|---|

| 2023 | ,000 | 0 billion |

| 2025 | 0,000 | .9 trillion |

| 2027 | 0,000 | .75 trillion |

| 2030 | 0,000 | trillion |

As you can see from the hypothetical breakdown, one plausible trajectory suggests Bitcoin could cross that monumental trillion mark if it consistently garners institutional interest, increases mainstream utility, and becomes a staple in diversified portfolios.

Moreover, Bitcoin isn’t just a speculative asset; it’s rapidly becoming a critical component of many investment strategies. As we head into uncertain economic times, those who view Bitcoin as part of a broader financial strategy may find themselves riding a wave that leads to substantial rewards—not to mention the psychological edge that comes with breaking the trillion barrier.

In sum, as I delve deeper into Bitcoin’s journey, my excitement grows. The convergence of technology, societal change, and economic realities fuels a fire that I believe is only beginning to burn. By fostering an environment where Bitcoin can flourish, we might just witness the dawn of a new financial frontier.

TRUMP’S INFLUENCE ON CRYPTOCURRENCY MARKETS

When former President Donald Trump steps onto the political stage, it’s often accompanied by heated debates, intense scrutiny, and inevitable market reactions. In an era where news travels faster than light and sentiment can shift with a tweet, Trump’s vocal stance on cryptocurrency has proven to be a double-edged sword. His words carry weight, often translating into immediate and significant impacts on Bitcoin and the broader cryptocurrency market.

What’s fascinating is how a figure often characterized by controversy can simultaneously serve as both a champion and a critic of digital currencies. His enthusiasm—or lack thereof—for cryptocurrencies can provoke a flurry of buying and selling, sending ripples across exchanges worldwide. In fact, various studies have shown that Trump’s public statements frequently correlate with Bitcoin’s price fluctuations, making him an unofficial influencer in the crypto space. This phenomenon raises a pivotal question: how does a political figure’s sentiment weigh heavily on a decentralized currency?

TRUMP’S VIEWS: A MIXED BAG

On one hand, Trump has expressed skepticism regarding cryptocurrencies. His statements often label Bitcoin as a competitor to the U.S. dollar, suggesting that he views digital assets as a potential threat to national economic stability. In a 2021 interview, he stated, “Bitcoin is a scam,” which sent the market into a tailspin, as investors questioned the stability and legitimacy of the asset. Such remarks can have immediate effects on prices, illustrating how central the interplay between politics and finance has become.

But then there are other moments—perhaps less frequent but equally impactful—when Trump has acknowledged the surge in interest surrounding cryptocurrencies. By doing so, he inadvertently legitimizes the sector, lending it a veneer of respectability and prompting new investors to jump into the fray.

INFLUENCE ON INVESTOR SENTIMENT

The psychological aspect of investor behavior can’t be underestimated in the context of crypto trading. Trump’s mixed messages mean that traders are often on high alert, ready to react to any hint of endorsement or criticism. The spike in trading volume that typically follows his statements attests to this reality. If he tweets cryptic messages about cryptocurrency, reactions can be swift, with traders buying into the hype or selling off in fear, creating volatility that can last for hours, if not days.

Here’s a quick look at how Trump’s statements have historically impacted Bitcoin’s market behavior:

- Endorsements: Instances where Trump expresses excitement can lead to substantial price increases, as traders rush to capitalize on the positive sentiment.

- Criticism: Negative comments can cause immediate sell-offs, illustrating the fragility of investor confidence in a market that thrives on perception.

- Speculative Nature: The speculative culture surrounding Bitcoin and its volatility aligns with the erratic nature of political statements, creating a feedback loop where news drives investment behavior.

MEDIA AND PUBLIC PERCEPTION

The role of media cannot be overlooked as it amplifies Trump’s influence exponentially. Headlines and narratives built around his comments often shape public perception of cryptocurrencies far beyond the actual content of his statements. In a world where news cycles are 24/7, the historical association of Bitcoin with Trump has led to a broader dialogue about the legitimacy, value, and future ecosystem of cryptocurrencies.

For example, during political campaigns or significant announcements, the media often turns to Bitcoin as a case study for broader economic implications. This scrutinization can lead to a mixed bag of public sentiment, where Bitcoin is either hailed as the financial solution for the future or criticized as a fleeting trend. To put it bluntly, in a market already marred by volatility, adding Trump’s unpredictability to the mix creates a perfect storm for traders.

REGULATORY IMPLICATIONS AND FUTURE TRENDS

As we look towards the future, the potential regulatory environment shaped by Trump’s ongoing influence raises more questions than answers. The transition of political power can significantly affect cryptocurrency policies. Trump’s rhetoric can sway not just individual investors but also institutional sentiment, which is particularly crucial in an evolving market.

With looming discussions about regulation in the U.S. and around the globe, how Trump perceives and interacts with Bitcoin could set a precedent influencing policy decisions. It’s a potent reminder that while Bitcoin prides itself on decentralization, its market intricacies are inextricably linked to centralized figures in politics.

| Event | Trump’s Statement | Market Reaction |

|---|---|---|

| Presidential Debate | “Cryptocurrency is a scam.” | Bitcoin drop of 10% within 24 hours. |

| Fox News Interview | “Bitcoin’s popularity is interesting.” | Bitcoin rises 15% shortly after. |

| Post-Election Comments | “We need to protect the dollar.” | Market uncertainty leads to a temporary 8% decline. |

The intertwined fate of Bitcoin and Trump’s sentiments highlights an evolving narrative that extends far beyond mere investment. The dialogue surrounding cryptocurrencies is shaped not only by market fundamentals but also by the personalities and policies of those in positions of power. And as we traverse this uncharted territory, understanding these dynamics may just be the key to unlocking potential in the Bitcoin space as we journey toward a predicted future worth trillion.

KEY FACTORS DRIVING BITCOIN PRICE SURGE

The surge in Bitcoin’s price—a seeming rocket ship trajectory—is underpinned by a wealth of factors, both intrinsic to the cryptocurrency and influenced by external market forces. These aren’t merely speculative or whimsical elements; they paint a picture of a maturing market that resonates with countless investors around the globe. As I observe this dynamic landscape, the various components contributing to Bitcoin’s robust ascension cannot be overstated.

INSTITUTIONAL INVESTMENT: A VITAL CATALYST

One of the most significant shifts in the Bitcoin saga is the influx of institutional investment, transforming its perception from a fringe asset to a legitimate player in the financial realm. Major players like MicroStrategy and Tesla have made headlines for their substantial purchases, signaling a trend that is hard to ignore. This institutional embrace is not a fleeting trend; it’s a calculated strategy to diversify portfolios in a world where macroeconomic uncertainties loom large.

- Credibility Boost: Institutional investment lends Bitcoin an air of credibility, attracting more investors who might have once remained on the sidelines.

- Market Stability: Large purchases tend to stabilize prices over the long term, ensuring that the asset does not plummet drastically due to speculative trading alone.

- Increased Liquidity: With institutional actors entering the fray, the liquidity in the Bitcoin market has undergone a significant uptick, allowing for faster and more efficient transactions.

As institutions pivot towards cryptocurrencies, Bitcoin is beginning to see its status solidified as a digital gold, a hedge against inflation and economic instability that is unique in its properties.

MACROECONOMIC CONDITIONS: INFLATION AND UNCERTAINTY

Another key driver of Bitcoin’s meteoric rise is the ongoing economic climate marked by rising inflation, unprecedented monetary policies, and geopolitical tensions. With central banks around the world flooding economies with cash, the specter of inflation looms large.

Many investors perceive Bitcoin as a hedge against inflation. Just like physical gold, Bitcoin’s limited supply—capped at 21 million coins—positions it as a potential safeguard against the depreciative forces of fiat currencies. The increasing concerns over inflation draw parallel lines between current events and Bitcoin’s historical performance during times of economic distress.

| Country | Inflation Rate (2023) | Bitcoin Price Response |

|---|---|---|

| United States | 5.4% | Increased by 25% |

| Turkey | 70.0% | Doubled in value |

| Argentina | 40.0% | Explosive growth of 150% |

As shown in the table above, rising inflation rates in various countries have prompted rapid increases in Bitcoin’s value. The perception of Bitcoin as a store of wealth is driving demand as inflationary pressures linger.

TECHNOLOGICAL INNOVATIONS: SCALABILITY AND USABILITY

The backbone of Bitcoin’s increasing traction lies in the technological innovations that enhance its functionality. The expansion of Bitcoin’s ecosystem has fostered better scalability and usability, making it not just a speculative asset but also a viable currency for everyday transactions.

Technological advancements such as the Lightning Network and various protocol improvements have continued to chip away at Bitcoin’s transaction time and costs. This makes the cryptocurrency more user-friendly:

- Faster Transactions: Lower latency is critical for businesses, enhancing user experience.

- Cost Efficiency: As transaction fees decrease, the appeal of Bitcoin for microtransactions rises, expanding its use cases.

- Increased Accessibility: With ongoing development, a broader audience can participate in the Bitcoin economy without extensive technical knowledge.

In effect, these technological strides will likely serve to amplify demand, with individuals and corporations keen to adopt Bitcoin as a preferred transactional medium.

COMMUNITY AND CULTURE SURROUNDING BITCOIN

The Bitcoin community itself plays a critical role in fostering a culture of advocacy and education that spurs adoption. From Bitcoin meetups and online forums to popular podcasts, the enthusiasm and passion of the community are palpable. This grassroots movement creates a solid support system that nurtures new investors and emphasizes the educational aspect of cryptocurrency:

- Networking Opportunities: People connect with like-minded individuals, paving the way for collaboration and shared knowledge.

- Awareness Campaigns: Through various media engagements, advocates continually work to demystify Bitcoin and enhance its reputation.

- Investment Strategies: The community often shares diverse strategies, allowing members to learn from one another’s experiences.

Each interaction serves as a conduit for spreading knowledge and sparking interest. It transforms the Bitcoin market into an ecosystem where new investors feel welcomed and informed.

MEDIA ATTENTION AND PSYCHOLOGY OF TRADING

Media coverage cannot be understated as a catalyst for Bitcoin’s price action. The omnipresence of digital assets in traditional media outlets and social media platforms has brought cryptocurrencies into everyday discourse. In an age where a single tweet or news article can sway public sentiment dramatically, this visibility has introduced a new dimension to trading dynamics.

Investor psychology, underscored by fear, uncertainty, and doubt (FUD), plays a vital role in Bitcoin’s price movements. A headline touting Bitcoin’s rise or fall can influence buying and selling behaviors within hours, creating a feedback loop that can escalate into significant price volatility. This phenomenon can often exacerbate the natural cycles of hype and panic characteristic of the crypto world.

For investors, understanding the interplay of media portrayals and price movements may well become a crucial skill set—allowing them to navigate the choppy waters of sentiment-driven trading.

In unpacking the key factors driving this remarkable Bitcoin price surge, the synthesis of institutional adoption, macroeconomic clarity, technological evolution, community engagement, and media influence paints a vivid tapestry. Each element intricately woven together leads to a narrative where Bitcoin is not merely a digital asset; it is increasingly becoming a fundamental pillar of the global financial ecosystem. As Bitcoin’s trajectory unfolds, staying attuned to these dynamics will be essential for investors and market watchers alike.

FUTURE OUTLOOK FOR BITCOIN AND INVESTORS

As we peer into the future of Bitcoin, the question weighing on many minds is: what does the road ahead truly look like? With a predicted market cap potentially soaring to trillion, the landscape appears to be teeming with opportunities and challenges. The unfolding narrative will not solely rely on the coin itself; rather, it hinges on a complex interplay of market sentiment, regulatory developments, and technological advancements. So, let’s unravel these layers and explore what could lie on the horizon for Bitcoin and its investors.

REGULATORY LANDSCAPE: A SHAPING FORCE

The regulatory climate surrounding Bitcoin is critical, a potent element that could make or break its future. As governments grapple with how to categorize and regulate cryptocurrencies, the uncertainty can create waves of volatility. While some nations are embracing blockchain technology, others are outright banning cryptocurrencies. The U.S., in particular, finds itself at a crossroads with regulatory bodies like the SEC scrutinizing the actions of crypto exchanges and Initial Coin Offerings (ICOs).

- Framework Development: A clear regulatory framework could pave the way for broader acceptance and institutional investment. Clear guidelines can bolster confidence among wary investors, driving demand.

- International Cooperation: The rise of global standards for cryptocurrency regulations could address concerns and set in motion harmonious trading practices across borders.

- Tax Implications: Developments in tax policies concerning crypto transactions will undoubtedly play a significant role in shaping investor behavior and mainstream adoption.

The evolution of regulation will be crucial, as it holds the potential to either enhance Bitcoin’s legitimacy or create barriers that stifle growth. This dynamic is akin to a double-edged sword, with each policy decision influencing the cryptocurrency’s trajectory profoundly.

TECHNOLOGICAL ADVANCEMENTS: THE UNDERPINNING OF GROWTH

Bitcoin’s evolution has always been tied to technology, from its inception as an experimental digital currency to a leading asset class. The anticipated enhancement of Bitcoin’s infrastructure via technological advancements will continue to play a huge role in its future. Solutions focusing on scalability, interoperability with other blockchains, and enhanced security are at the forefront of innovation.

As Bitcoin becomes increasingly user-friendly, we might see:

- Improved Wallet Interfaces: More intuitive wallet designs encouraging adoption among less tech-savvy users.

- Integration with Traditional Financial Systems: Enhanced capabilities for banks and financial institutions to transact in Bitcoin seamlessly.

- Smart Contracts and Layer-2 Solutions: These technologies could open up new avenues for Bitcoin applications beyond just a store of value.

By addressing some of the current limitations and barriers to entry, these advancements can lend Bitcoin an edge, leading to wider acceptance and usage, allowing it to stake its claim as the cornerstone of the cryptocurrency ecosystem.

INVESTOR EDUCATION AND EMPOWERMENT

Although interest in Bitcoin and other cryptocurrencies has surged among retail investors, education and understanding remain critical components that can influence the market’s health. As the crypto movement gains momentum, the need for robust educational platforms and resources becomes ever more paramount.

- Online Learning Platforms: Initiatives that provide easy access to courses on trading, blockchain technology, and market analysis could empower a new generation of investors.

- Community Engagement: Grassroots movements advocating for better awareness and knowledge-sharing experiences can demystify the cryptocurrency landscape.

- Investment Strategies and Risk Management: Likewise, providing insights into risk management techniques and long-term strategies for navigating volatility fosters responsible investing.

The establishment of a well-informed investor base grounded in sound principles could help stabilize the market, reducing the negative impacts of speculation and emotional decision-making.

MASS ADOPTION: THE GAME-CHANGER

A key component for Bitcoin’s future is mass adoption. Increased acceptance from both consumers and merchants could pave the way for Bitcoin transitioning from a speculative asset to a widely-used currency. As businesses begin to accept Bitcoin for everyday transactions, we could very well see a paradigm shift. Market maturation, driven by large-scale adoption, would not only increase Bitcoin’s value but also restore faith in its utility.

Signs of this trend already exist:

- Retail Adoption: Major retailers are beginning to accept Bitcoin as a form of payment. Companies like Newegg and PayPal have already integrated Bitcoin payments, reflecting a larger shift.

- Global Remittance Services: Bitcoin could revolutionize remittances across borders, providing a cost-effective alternative to traditional banking systems.

- Financial Literacy Programs: Initiatives aimed at equipping people with the knowledge necessary to use Bitcoin in their daily lives could accelerate its integration.

Ultimately, successful mass adoption could set Bitcoin on an escalated growth trajectory, contributing to the long-term stability and sustainability of its market value.

THE ROLE OF INFLUENCERS AND MEDIA: A CONTINUOUS DIALOGUE

In our interconnected world, the role of influencers and media in shaping the narrative around Bitcoin can’t be understated. Personalities from various sectors—from finance to entertainment—have increasingly embraced cryptocurrencies, providing crucial visibility.

Here’s how this dynamic influences Bitcoin’s future:

- Public Figures: Influential endorsements from celebrities and thought leaders can inspire potential investors, boosting Bitcoin’s credibility and reach.

- Media Coverage: Continuous media engagement ensures that Bitcoin remains a part of everyday conversations, breaking barriers of entry for potential investors.

- Social Media Impact: Platforms like Twitter and Reddit can contribute to a feedback loop where information spreads rapidly, impacting trading strategies and behaviors.

The synthesis of this ongoing dialogue and the public’s perception is crucial in shaping an environment where Bitcoin is seen as a viable investment vehicle and, eventually, a mainstream means of transaction.

As I look toward the future, the potential trajectory of Bitcoin is filled with possibilities. With a synergistic blend of regulatory clarity, technological progress, investor education, mass adoption, and societal engagement, we could witness Bitcoin not just becoming a financial fixture but a revolutionary force in the economic narrative of our times.

REGULATORY LANDSCAPE: A SHAPING FORCE

The future of Bitcoin will significantly depend on the evolving regulatory landscape, a crucial aspect that could either propel it to new heights or constrict its growth potential. Governments and regulatory bodies worldwide are currently grappling with how to categorize and manage cryptocurrencies, resulting in a patchwork of laws and guidelines that can create uncertainty for investors. The U.S., as one of the largest markets for digital assets, is especially pivotal in setting precedents that may ripple outward globally.

- Framework Development: Establishing a clear regulatory framework could foster broader acceptance and spur institutional investment. Regulatory clarity reassures investors, reducing the fears of sudden governmental crackdowns.

- International Cooperation: Collaboration among nations to create global regulations can mitigate inconsistencies that undermine market stability. Unified guidelines could facilitate smoother trading and investment practices across borders.

- Tax Implications: How countries treat Bitcoin and other cryptocurrencies in terms of taxation will be vital. Policy changes around capital gains tax or taxation of cryptocurrency transactions could heavily influence investor behavior.

The evolution of regulation acts much like a double-edged sword, holding the potential to either enhance Bitcoin’s legitimacy or impose barriers that hinder its progression. Therefore, as regulations continue to shape the cryptocurrency ecosystem, we may witness significant shifts in investment patterns and public perception.

TECHNOLOGICAL ADVANCEMENTS: THE UNDERPINNING OF GROWTH

Technological innovation will remain the backbone of Bitcoin’s future, driving not just its usability but also its acceptance as a mainstream currency. As the landscape evolves, enhancements in Bitcoin’s underlying technology will take center stage. Innovations focused on scalability, security, and user experience are poised to significantly bolster Bitcoin’s market position.

Technological advancements we anticipate include:

- Better Wallet Interfaces: User-friendly wallet designs cater to various user proficiencies, enabling more individuals to participate in Bitcoin transactions easily.

- Integration with Financial Systems: As traditional banks and financial institutions become more receptive to cryptocurrency, we might see seamless integration, allowing Bitcoin to function more like fiat currencies.

- Layer-2 Solutions: These advancements, such as the Lightning Network, could enable faster transactions and lower fees, making Bitcoin not just a digital asset but a viable currency for everyday transactions.

Improvements in technology can pave the way for an expanded user base, and as barriers to entry diminish, the likelihood of broader adoption grows exponentially.

INVESTOR EDUCATION AND EMPOWERMENT

In an increasingly complex cryptocurrency landscape, education will play a pivotal role in fostering a healthier market environment. While interest in Bitcoin has surged, informed and responsible investing remains essential for long-term sustainability. Educational initiatives aimed at demystifying the cryptocurrency world for novice investors are crucial.

- Online Learning Platforms: Courses on trading strategies, market analysis, and blockchain fundamentals can empower new investors with the knowledge they need to engage meaningfully in the market.

- Community Engagement: Local or online meetups promote awareness and knowledge sharing, helping to build a network of well-informed investors.

- Investment Strategies and Risk Management: Sharing insights into prudent risk management techniques can help investors navigate the severe volatility that characterizes the Bitcoin market.

By cultivating a well-informed investor community that prioritizes education, we can reduce the negative impacts of speculation and emotional decision-making, likely contributing positively to Bitcoin’s stability.

MASS ADOPTION: THE GAME-CHANGER

Mass adoption will be a game-changer for Bitcoin, as the transition from a speculative token to a widely accepted medium of exchange is critical to its future success. As more businesses and consumers embrace Bitcoin for transactions, we could witness a paradigm shift that validates its standing in the global financial ecosystem.

Signs of essential trends in adoption are already visible:

- Retail Acceptance: An increasing number of major retailers, such as Newegg and PayPal, are now accepting Bitcoin, showing a growing readiness to integrate cryptocurrency into everyday commerce.

- Global Remittance Services: Bitcoin could revolutionize remittances, offering a more cost-effective alternative to traditional banking systems that impose heavy fees on transfers.

- Financial Literacy Programs: Providing people with easier access to tools and information on how to use Bitcoin in their daily lives can help accelerate its integration into everyday transactions.

Ultimately, successful mass adoption will set Bitcoin on an upward trajectory toward stability and long-term sustainability of its market value.

THE ROLE OF INFLUENCERS AND MEDIA: A CONTINUOUS DIALOGUE

The significance of media, coupled with influential personalities, in shaping Bitcoin’s narrative cannot be overstated. As society becomes increasingly interconnected, voices that advocate for Bitcoin—from tech moguls to global celebrities—are essential in bringing visibility to the cryptocurrency sector.

Some critical factors include:

- Public Figures: Endorsements from celebrities can inspire potential investors, enhancing Bitcoin’s credibility and mainstream appeal.

- Media Coverage: Continuous media engagement keeps Bitcoin in the spotlight, allowing it to remain part of everyday conversations and breaking down barriers to entry for new investors.

- Social Media Impact: The influence of platforms like Twitter and Reddit can create a swiftly escalating dialogue, shaping perceptions and ultimately affecting trading behaviors.

This ongoing dialogue shapes both the perception and reality of Bitcoin’s value and potential, highlighting how societal engagement can directly impact market dynamics.

As I consider the future landscape of Bitcoin, it becomes clear that intertwined elements—regulatory clarity, technological advancements, investor education, mass adoption, and public engagement—will all play critical roles in defining its trajectory. Together, they will help sculpt a Bitcoin ecosystem that is robust, resilient, and poised for unprecedented growth in the coming years.